Introduction

Welcome to our comprehensive guide on real estate investments! In this article, we will delve deep into the world of real estate, exploring the various aspects, strategies, and benefits of investing in this lucrative market. Whether you are a seasoned investor or a beginner looking to step into the world of real estate, this guide will equip you with the knowledge and insights needed to make informed investment decisions.

Understanding Real Estate Investments

Real estate investments involve the purchase, ownership, management, rental, or sale of properties for the purpose of generating profit. It is a versatile investment avenue that offers a wide range of opportunities, including residential properties, commercial properties, and even raw land.

Key Benefits of Real Estate Investments

1. Diversification and Stability

Real estate investments provide a hedge against market volatility. Unlike stocks and bonds, which can be subject to significant fluctuations, real estate tends to be more stable and less influenced by short-term market trends. By diversifying your investment portfolio with real estate assets, you can reduce overall risk and improve long-term stability.

2. Appreciation and Wealth Building

One of the most attractive features of real estate investments is the potential for property appreciation. Over time, well-located properties tend to increase in value, allowing investors to build equity and accumulate wealth. Moreover, real estate offers the opportunity to leverage your investment through mortgage financing, which can further boost returns.

3. Passive Income through Rental Properties

Investing in rental properties can create a steady stream of passive income. By owning residential or commercial properties and leasing them to tenants, investors can generate regular rental payments, providing a reliable source of income. Rental income can be used to cover mortgage payments, property maintenance, and other expenses, ultimately leading to increased cash flow.

4. Tax Advantages

Real estate investments offer various tax benefits that can enhance overall returns. Deductible expenses such as property taxes, mortgage interest, and maintenance costs can significantly reduce taxable income. Additionally, investors may benefit from depreciation deductions, further lowering their tax burden.

Key Strategies for Successful Real Estate Investing

1. Conduct Thorough Market Research

Before making any investment decisions, it’s crucial to conduct comprehensive market research. Analyze local real estate trends, vacancy rates, rental demand, and economic indicators. Understanding the current market conditions will help you identify lucrative opportunities and make informed choices.

2. Choose the Right Location

The old adage “location, location, location” holds true in real estate. A property’s location plays a significant role in its potential for appreciation and rental income. Look for properties in areas with strong economic growth, infrastructure development, and a high demand for housing or commercial space.

3. Determine Your Investment Strategy

Real estate offers various investment strategies, such as fix-and-flip, buy-and-hold, or commercial leasing. Define your investment goals and risk tolerance to select the strategy that aligns with your objectives. Each approach has its own set of considerations, so careful planning is essential.

4. Calculate Potential Returns and Risks

Before committing to any investment, thoroughly evaluate the potential returns and associated risks. Calculate the property’s potential cash flow, return on investment (ROI), and break-even point. Assess potential risks such as market fluctuations, maintenance costs, and tenant turnover.

5. Build a Strong Network

Networking is a vital aspect of successful real estate investing. Connect with experienced investors, real estate agents, property managers, and other professionals in the industry. Their knowledge and expertise can prove invaluable in identifying opportunities and navigating challenges.

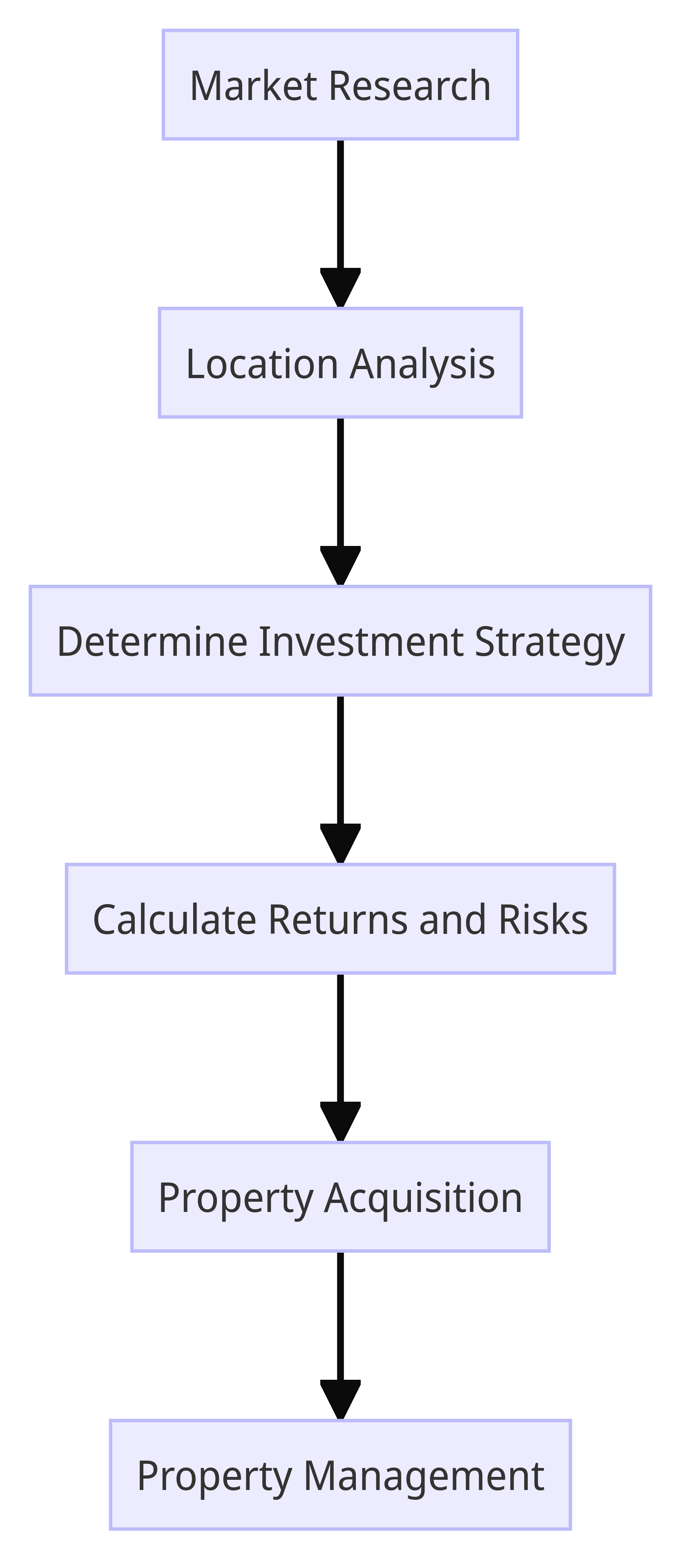

Diagram: Real Estate Investment Process

Here’s a simple diagram depicting the real estate investment process:

Conclusion

Congratulations! You are now equipped with essential knowledge to make strategic real estate investments. Remember, successful real estate investing requires careful planning, due diligence, and a long-term perspective. By following the strategies outlined in this guide and staying informed about market trends, you can maximize your chances of achieving financial success through real estate investments. Happy investing!

Written by Chinedu Obikwelu

07039753827

info@fbgestate.com